The Slow Decline of American Industry: How Our Leaders Sold Us Out

It didn’t happen all at once.

There was no grand announcement. No solemn memorial. No front-page obituary.

But make no mistake: the American industrial economy — the one that once built skyscrapers, launched moon missions, and gave blue-collar families a path to middle-class security — is dead. And it wasn’t taken from us by foreign powers or market forces. It was killed — slowly, deliberately — by the very people we trusted to protect it.

This isn’t just a story about outsourcing or automation. It’s about betrayal. About political cowardice dressed up as economic strategy. About Wall Street boardrooms that replaced factory floors. And about how — over the span of five decades — America went from the world’s manufacturing engine to a hollowed-out shell selling off its last remaining brands to the highest bidder.

To understand how we got here, we have to go all the way back. Before NAFTA. Before Reagan. Even before Nixon.

It starts with Lyndon B. Johnson.

Part I: LBJ and the Great American IOU

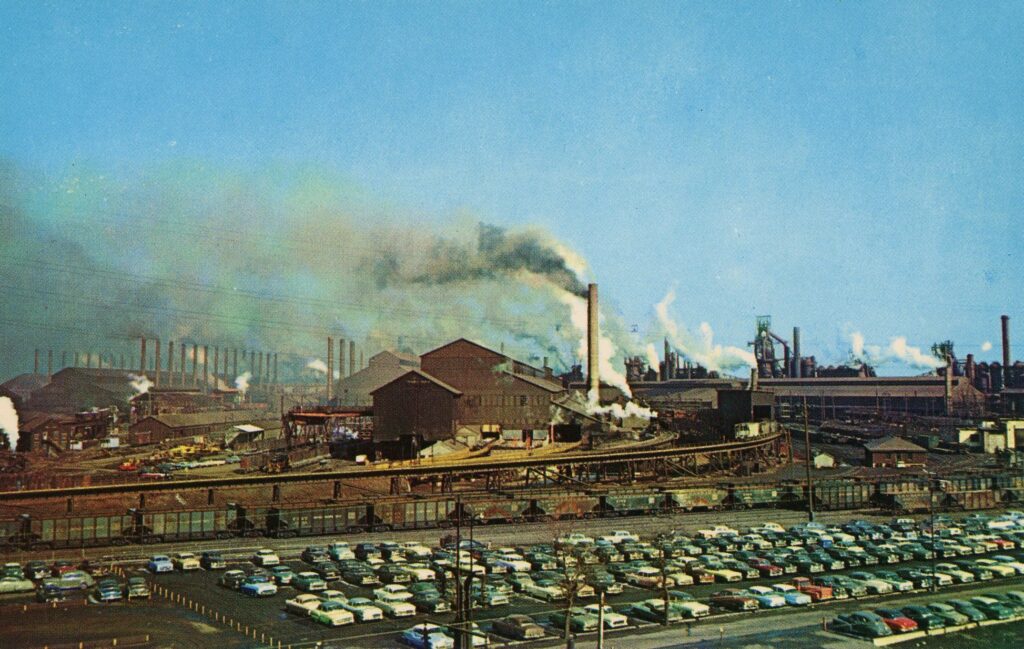

When Lyndon B. Johnson took the oath of office aboard Air Force One in November 1963, America stood astride the world like a colossus. It was a nation defined by steel, cement, oil, and ambition. Its factories churned day and night. Its cities teemed with union workers, craftsmen, and engineers. Its economy was the envy of the world — not because of financial gimmicks, but because it made things.

Real things.

American might wasn’t measured in derivatives or tech IPOs. It was measured in the number of ships you could launch, homes you could build, and miles of highway you could pave. The middle class was broad and growing. Families could afford houses, cars, and vacations on a single income. College was affordable. Retirement was feasible. The American Dream, while never universal, was at least structurally possible.

And underpinning all of it — the factories, the wages, the booming postwar consumer economy — was a system of monetary order known as Bretton Woods.

What Was Bretton Woods — and Why Did It Matter?

Most Americans have never heard of it, but the Bretton Woods Agreement was the bedrock of global capitalism from 1944 through the early 1970s. Named after the sleepy New Hampshire town where it was negotiated, Bretton Woods was an ambitious plan to bring order to the international monetary system after World War II.

Under this system, the U.S. dollar became the world’s reserve currency. Other nations would peg their currencies to the dollar, and the U.S. — in turn — would back the dollar with gold. Every dollar in circulation was supposed to be redeemable for gold at a fixed rate: $35 per ounce. This “gold standard lite” ensured global stability, restrained inflation, and prevented governments from printing money to finance pet projects or endless wars.

Bretton Woods was designed to prevent the kind of currency manipulation and financial chaos that had fueled the Great Depression and the rise of fascism. And it worked — for a time.

The system only had one major flaw: it required discipline. And that’s where LBJ broke the covenant.

The Johnson Paradox: Guns, Butter, and Budgetary Fiction

Johnson’s presidency was marked by paradox. He was a Southern populist and a New Deal heir, a man obsessed with fighting poverty and expanding civil rights — but also with proving American dominance on the world stage. His domestic agenda, known as The Great Society, was the most sweeping expansion of federal programs since FDR.

Medicare. Medicaid. Food stamps. Head Start. Public broadcasting. Mass transit subsidies. Federal housing initiatives. Urban renewal. Education funding. Civil rights enforcement.

It was, in many ways, a moral revolution — and one that came with a staggering price tag.

Simultaneously, LBJ was escalating the war in Vietnam, pouring hundreds of thousands of troops and billions of dollars into a distant jungle conflict that few Americans fully understood and even fewer supported by the war’s end. The problem was this: he refused to choose.

Rather than cutting back on domestic programs to fund the war — or raising taxes to pay for both — Johnson chose to do it all. The U.S. federal budget ballooned. Deficit spending soared. And the gold-backed dollar, the cornerstone of Bretton Woods, began to wobble.

In economic terms, this was a quiet revolution.

The Beginning of the End for Hard Money

LBJ’s fiscal choices violated the implicit rules of Bretton Woods. Foreign governments, especially in Europe, grew nervous. They saw the United States flooding the world with dollars — many of which were not backed by corresponding gold reserves. Trust in the dollar began to erode.

France, under Charles de Gaulle, called America’s bluff. His government began redeeming U.S. dollars for gold, shipping literal tons of bullion out of Fort Knox back to Paris. Others soon followed. By 1968, the U.S. gold stock had dropped by more than half from its postwar peak. The Treasury was being drained.

This wasn’t a minor hiccup. It was the beginning of a full-blown currency crisis — one that would culminate a few years later when Nixon slammed the door on gold convertibility altogether.

But the first domino had already fallen.

The cause? A president who tried to remake America at home and project its power abroad without paying the bill.

Why It Mattered: The Seeds of Structural Decay

At first, LBJ’s deficit spending seemed harmless. The economy was growing. Incomes were rising. But beneath the surface, his choices were laying the groundwork for long-term instability.

When a government starts spending beyond its means without restraint, it triggers a chain reaction:

- Inflation rises, devaluing wages and savings.

- Foreign creditors lose faith, demanding higher interest or hard assets.

- The currency becomes untrustworthy, which undermines trade.

- The monetary system fractures, giving rise to financial speculation and short-termism.

Every one of these dynamics — every single one — would come to define the post-Bretton Woods era that emerged in the 1970s and metastasized through the 1980s and 1990s.

LBJ didn’t kill American industry outright. He didn’t close factories or sign trade deals that gutted entire regions.

But he cracked the foundation.

His refusal to finance his agenda honestly opened the door for the next phase: Nixon’s shock, Reagan’s neoliberalism, and ultimately Clinton’s globalization. All of them — in different ways — were responses to the budgetary and monetary chaos unleashed in the 1960s.

A New Kind of Politics: Borrow Now, Pay Never

The most enduring legacy of LBJ’s presidency wasn’t the Great Society or Vietnam. It was the normalization of deficit spending as default policy.

Future presidents took the same playbook and ran with it. Some ran farther. Others ran faster. But all of them — left and right — came to accept the idea that the United States could have everything, pay for nothing, and suffer no consequences.

It was an illusion.

The bill would eventually come due — not in the form of a debt collector, but in the slow erosion of economic sovereignty. The weakening of the middle class. The loss of manufacturing power. The rise of financial speculation over real production. The decay of infrastructure. And the hollowing out of entire regions of the country.

What began with LBJ’s IOUs would end in a system that rewarded stock buybacks over R&D, hedge fund profits over pensions, and foreign investment over domestic reinvestment.

Final Thought: The End of American Restraint

There’s a tendency to look back at the Johnson era with nostalgia — a time of national ambition and moral progress. And yes, in many ways, it was. But beneath the headlines and the legislation, something darker was taking root.

The quiet abandonment of economic restraint. The first cracks in the monetary system. The willingness of leaders to mortgage the country’s long-term stability for short-term gain.

LBJ may have championed the war on poverty, but in the process, he fired the first shots in the war on American industry — a war that would be waged not with tariffs or treaties, but with deficits, inflation, and deregulation.

The gold anchor was slipping. And the tide was about to rise.

Next up: Nixon.

Part II: Nixon, the Dollar Crisis, and the Death of Gold

By the end of the 1960s, the American economy was running hot — too hot. Under the strain of Lyndon B. Johnson’s simultaneous funding of the Great Society and the Vietnam War, the U.S. government was hemorrhaging money. Foreign governments noticed.

As more dollars flooded the global economy, trust in the greenback’s value began to erode. Remember: under Bretton Woods, the dollar was supposed to be as good as gold — literally. But countries like France, West Germany, and Switzerland began to suspect that the United States no longer had enough gold in reserve to back the staggering number of dollars circulating worldwide.

They were right.

Between 1958 and 1971, U.S. gold reserves plummeted as foreign governments exchanged their dollars for physical gold. In 1958, the U.S. held over 20,000 tons of gold. By 1971, that number had fallen to under 9,000 tons — and panic was spreading.

The U.S. was on the verge of a currency collapse.

That’s when Richard Nixon stepped in.

The Nixon Shock: “We’re All Keynesians Now”

On August 15, 1971, in a dramatic nationally televised address, President Richard Nixon announced what would later be dubbed the “Nixon Shock.” Without warning, he unilaterally suspended the dollar’s convertibility to gold, effectively killing the Bretton Woods system in one fell swoop.

This was no minor policy tweak. It was the financial equivalent of detonating a nuclear bomb on the global economy.

Nixon justified the move as a temporary measure to stop “international speculators” and defend the U.S. dollar. In reality, the U.S. government had spent its way into a corner — and rather than curb spending or raise taxes, Nixon simply cut the dollar loose.

He didn’t consult allies. He didn’t go through Congress. He just did it.

The gold standard was gone.

From that moment on, the U.S. dollar became a pure fiat currency — backed by nothing but political promises and market confidence. It was the beginning of a new economic era, one where money could be printed freely, debts could balloon indefinitely, and inflation became a permanent feature of American life.

Unleashing the Dollar: From Discipline to Debt

The death of Bretton Woods removed the last meaningful constraint on federal spending and monetary expansion. Under the gold standard, there had been guardrails — overspending would drain gold reserves, forcing a government to tighten its belt.

Now? The guardrails were gone.

Washington could borrow endlessly, print at will, and monetize deficits without limit. The consequences came fast.

By the mid-1970s, inflation skyrocketed. Between 1972 and 1980, the consumer price index nearly doubled. The purchasing power of the average American began to erode. Real wages stagnated. Savings lost value. Pension funds saw diminished returns. Meanwhile, Wall Street adapted — and thrived.

The financial class didn’t suffer. They evolved.

They began to treat money as an abstract tool, untethered from real-world production. Debt became an asset. Leverage became a strategy. And for the first time, the gap between Main Street and Wall Street began to widen into a canyon.

The Global Fallout: Welcome to Petrodollar Hegemony

Without gold, the U.S. needed a new way to preserve demand for the dollar. The solution? Oil.

In 1974, following the OPEC oil embargo, the Nixon and Ford administrations cut a deal with Saudi Arabia: in exchange for U.S. military protection and arms sales, the Saudis agreed to sell their oil only in U.S. dollars — and to reinvest the surplus into U.S. Treasury bonds and financial markets.

Thus was born the Petrodollar system — an artificial foundation for dollar supremacy that ensured every country needing oil (i.e., every country on Earth) also needed U.S. dollars.

This arrangement had two effects:

- It artificially sustained global demand for U.S. currency, keeping it dominant despite its lack of gold backing.

- It shifted America’s industrial base toward finance, energy geopolitics, and military projection — away from domestic production.

In short: America stopped exporting goods. It began exporting dollars, debt, and war.

The Industrial Consequences: America Loses Its Edge

The 1970s were a turning point. Inflation, oil shocks, and declining real wages battered the working class. But even more important was the psychological shift among the nation’s elite.

In the wake of the Nixon Shock, American policymakers and business leaders stopped thinking like builders. They began thinking like speculators.

Why reinvest in factories, machinery, and long-term development when you could extract value through arbitrage, leverage, and currency games?

Manufacturing began to decline — slowly at first, then more rapidly. From 1970 to 1980, manufacturing as a share of U.S. GDP fell from 24% to 20%. Over the next two decades, it would fall even further.

Instead of re-industrializing or correcting course, the government doubled down on deregulation and financial expansion. Nixon’s decision to nuke the gold standard didn’t just change monetary policy — it rewired the entire economy to prioritize capital over labor, finance over production.

A New Class War Begins

The end of Bretton Woods wasn’t just an economic pivot. It marked the beginning of a new class dynamic — one where white-collar investors, consultants, and financial engineers rose to dominance, while blue-collar workers were slowly discarded.

It was a turning point where national policy no longer aimed to build America. It aimed to manage it — and eventually, to liquidate it for profit.

Factories closed. Unions weakened. Wages stagnated. But the Dow Jones kept climbing.

The investor class flourished while the middle class began its long decline — a trend that would only accelerate with the rise of globalization, Reaganomics, and the tech boom.

Final Thought: Nixon Didn’t Kill American Industry — He Just Cut the Brake Lines

The collapse of the gold standard wasn’t the end of America’s manufacturing strength. But it was the moment we severed our economy from any sense of discipline, restraint, or long-term stewardship.

Nixon’s move may have been necessary in the short term — but it opened the door to an entirely new economic philosophy, one that worshiped growth at all costs and sacrificed stability, community, and sovereignty for financial gain.

The country didn’t fall apart overnight. But the rot had started to spread.

Next came Reagan.

Part III: Reagan, Deregulation, and the Wall Street Takeover

By the time Ronald Reagan took office in 1981, America was no longer riding high on postwar prosperity. Inflation was surging. Unemployment was rising. The manufacturing base had begun to buckle. And the once-reliable foundations of the Bretton Woods era had been replaced with floating currencies, volatile markets, and spiraling debt.

Reagan didn’t cause the economic crisis he inherited — but the way he responded to it changed the trajectory of the country forever. Because instead of rebuilding America’s industrial engine, he made a conscious choice:

To serve Wall Street.

Morning in America — for the Investor Class

Reagan’s presidency ushered in a new gospel: supply-side economics, better known as “trickle-down.” The idea was simple — and seductive: cut taxes for the wealthy and corporations, slash regulation, and let the so-called free market create growth that would eventually lift everyone.

But the reality? It created the biggest wealth transfer in modern history — upward.

Corporate tax rates were slashed. Capital gains taxes were cut. Estate taxes were weakened. And with every move, the investment class consolidated more wealth and power. Meanwhile, Reagan sold the public a fantasy — one of freedom, optimism, and bootstrap grit — even as the institutions that supported the working and middle classes were systematically dismantled.

For America’s industrial workers, it wasn’t “morning in America.” It was a long, painful twilight.

The War on Labor

Reagan didn’t just empower Wall Street — he declared war on the labor movement, the backbone of industrial America.

The most infamous moment came in 1981, when members of the Professional Air Traffic Controllers Organization (PATCO) went on strike demanding better working conditions and pay. Reagan responded not with negotiation, but with the largest mass firing of federal employees in U.S. history, terminating over 11,000 air traffic controllers.

The message was clear: union power was over.

This single act emboldened corporations across the country to take a harder line with organized labor. Union membership plummeted. Collective bargaining power eroded. Pension plans were frozen or scrapped entirely. And just like that, the American worker — once a central stakeholder in the national economy — became a cost center to be managed.

In Reagan’s America, the people who built the country’s wealth were no longer partners in prosperity. They were obstacles to efficiency.

Deregulation Nation

Reagan’s deregulatory blitz hit nearly every sector of the economy. Industries that had once been tightly controlled in the name of public interest were suddenly handed over to the invisible hand of the market.

- Airlines: Deregulated under Carter but expanded under Reagan, leading to mega-mergers, rising fees, and less service to smaller cities.

- Telecommunications: AT&T was broken up, but the result wasn’t lasting competition — it was a new wave of consolidation years later.

- Banking and finance: Reagan’s administration began relaxing restrictions on savings and loan institutions — a decision that would later help fuel the S&L crisis.

- Antitrust enforcement: All but abandoned. Mergers exploded. Monopolistic practices went largely unchecked.

What all of this meant in practice was that corporate power went supernova. The safeguards designed to protect workers, consumers, and communities were bulldozed. Wall Street ran wild.

And Reagan’s appointees cheered it on.

Wall Street Takes the Wheel

Behind all the patriotic speeches and tax cut celebrations was a deeper transformation: the financialization of the American economy.

For most of the 20th century, corporations made money by producing things — cars, steel, appliances, electronics. But under Reagan, and increasingly afterward, profits came from financial engineering instead of industrial output.

- Stock buybacks, once considered borderline manipulation, were legalized under Reagan in 1982 — allowing companies to inflate their share prices by repurchasing their own stock.

- Private equity firms and leveraged buyouts became common, with financiers like Mitt Romney’s Bain Capital acquiring industrial firms only to strip them for parts, load them with debt, and lay off workers.

- Hostile takeovers turned once-stable corporations into casino chips, with executives obsessed not with long-term innovation but with short-term stock gains.

This shift hollowed out the manufacturing core of the country. Plants were shut down not because they were unproductive, but because they weren’t profitable enough to satisfy Wall Street.

The American worker was no longer a valued asset. They were a line item. And Reagan’s policies had built the architecture that made their liquidation profitable.

Immigration, Wages, and the Two-Tier Economy

While deregulation and financialization gutted industrial America from the top, another slow burn was happening beneath the surface — one that’s still politically radioactive today: wage suppression through immigration policy.

Reagan signed the Immigration Reform and Control Act in 1986. It granted amnesty to roughly 3 million undocumented immigrants — a gesture widely seen as humane at the time. But it also failed to create meaningful employer penalties for hiring new undocumented workers. That was no accident.

Big business wanted a cheap, pliable labor pool.

Over time, industries like meatpacking, agriculture, and construction — once union-dominated sectors with strong wages — became dominated by underpaid, non-union, often undocumented workers. This exerted downward pressure on wages across the board, especially in the low-skilled and semi-skilled sectors.

And while this helped companies maintain profits, it fractured the working class — along racial, linguistic, and cultural lines.

Reagan’s policies didn’t just erode the economic power of industrial workers. They atomized their solidarity — ensuring that class consciousness would be replaced with cultural resentment and division.

Sound familiar?

A New Religion: Markets Above All

At the heart of Reagan’s legacy is a dangerous ideology — one that outlived his presidency and infected both parties:

“Government is not the solution to our problem; government is the problem.”

With that phrase, Reagan didn’t just signal his intention to shrink the state. He delegitimized the very idea that democratic institutions should shape markets in the public interest.

From that point forward, unregulated capitalism became doctrine. Market logic infiltrated everything:

- Public schools were treated like profit centers.

- Infrastructure was privatized.

- Healthcare became a commodity.

- Even the military became a client of private contractors and consultants.

The state no longer protected the working class from the market’s excesses. It enabled those excesses.

And for the first time in modern American history, the question wasn’t “how do we build a stronger industrial base?” but “how do we generate higher returns — now?”

The Bipartisan Continuation of a Disaster

Perhaps the most damning part of Reagan’s legacy is that his vision didn’t die when he left office. It became gospel.

Bill Clinton embraced free trade and deregulation with fervor. Obama stacked his cabinet with Wall Street veterans. Biden, despite a more populist tone, surrounded himself with neoliberals and globalists.

There’s no serious political movement in Washington today advocating for re-industrialization at scale. Because the donor class — the people who fund campaigns and write policy memos — already won. They got what they wanted:

A government that serves capital, not labor.

And Reagan was the architect of that shift.

Coming Up: Part IV — Clinton, Globalization, and the Final Betrayal

We’ve seen how Johnson cracked the fiscal foundation, how Nixon shredded the dollar’s golden tether, and how Reagan gave the keys to Wall Street. But the final phase of this story — the one that truly nailed shut the coffin of American industry — came in the 1990s.

NAFTA. WTO. Most Favored Nation status for China.

You know what’s coming.

And it only gets worse from here.

Part IV: NAFTA, Neoliberalism, and the Final Nail in the Coffin

By the time Bill Clinton took the oath of office in January 1993, the American industrial base was already battered — but not yet broken. Nixon had torn gold from the dollar. Reagan had swung a wrecking ball through unions. Wall Street had begun metastasizing into something parasitic, feeding not on innovation, but on speculation.

Clinton just finished the job.

The NAFTA Mirage

Clinton campaigned as a “New Democrat” — code for pro-business, pro-trade, and corporately housebroken. He promised modernization. Competitiveness. Efficiency. His signature achievement in that realm? NAFTA, the North American Free Trade Agreement, finalized with help from George H.W. Bush but pushed over the finish line by Clinton’s administration in 1994.

It was sold to the American people as a win-win: access to Mexican markets, cheaper goods for consumers, and a more “globalized” economy. The future, they said, was about services and software — not smokestacks.

But beneath the marketing slogans was a reality that even the most naive policy wonk should have seen coming.

Corporations didn’t see NAFTA as a means to export products. They saw it as a means to export jobs.

- Ford shifted plants south of the border.

- Levi Strauss closed nearly every U.S. factory.

- Carrier, Whirlpool, GE — all followed suit.

This wasn’t strategic modernization. This was industrial abandonment. A full-scale evacuation from middle-class American labor.

The Numbers Don’t Lie — But the Elites Did

Between 1994 and 2001, the Economic Policy Institute estimates the U.S. lost over 879,000 jobs due directly to NAFTA — most in manufacturing. But that’s just the beginning. When you factor in the ripple effects — supplier networks, transportation, logistics, small businesses tethered to industrial hubs — the losses number in the millions.

What filled the void?

- Big-box retail jobs paying half the wage, with zero benefits.

- Call center gigs, many of which were eventually outsourced, too.

- A vast underclass of “independent contractors” cobbling together income in what would later be known as the gig economy.

This was not evolution. It was liquidation.

It didn’t lead to better jobs. It led to more fragile ones. And for the first time in modern history, younger generations began to face worse economic prospects than their parents — not because of laziness or entitlement, but because the ladders of stability were being ripped up by elites in both parties.

Wall Street in the West Wing

Clinton’s NAFTA push wasn’t just bad policy — it was a doctrinal shift. The full institutionalization of neoliberal economics: deregulation, privatization, globalization, and the religion of “free markets” above all else.

Clinton surrounded himself with economic advisors who might as well have had Goldman Sachs business cards. People like Robert Rubin and Larry Summers didn’t just influence policy — they were policy. And under their guidance, Clinton’s administration:

- Repealed Glass-Steagall, the Depression-era law separating commercial and investment banking.

- Promoted unrestricted capital mobility, allowing corporations to shift money — and jobs — anywhere labor was cheaper.

- Turned a blind eye to the explosion of derivatives and exotic financial instruments that would later tank the global economy in 2008.

The White House became an extension of Wall Street. And the working class? An afterthought.

The China Shock: Globalization’s Killing Blow

If NAFTA was the warm-up act, China’s entry into the WTO in 2001 was the main event.

The groundwork was laid under Clinton, with promises that bringing China into the fold would democratize its markets and open massive new demand for U.S. exports. But in reality, it opened the floodgates for unprecedented industrial offshoring.

Factories that had limped through NAFTA couldn’t compete with Chinese wages, state-backed subsidies, and near-total regulatory freedom. Executives across every sector — apparel, electronics, furniture, tools, packaging — raced to relocate production.

According to economists David Autor, David Dorn, and Gordon Hanson, the U.S. lost over 3.4 million jobs to China between 2001 and 2013 — nearly 80% in manufacturing.

This was not a peaceful transition. It was a mass extinction event.

- Detroit lost its tool-and-die shops.

- Hickory, North Carolina, once the furniture capital of America, became a ghost town.

- Rust Belt cities that once housed the heart of American productivity began to resemble abandoned war zones.

A Culture of Managed Decline

The damage wasn’t just economic. It was psychological. For decades, Americans had been told that a good job plus hard work equaled upward mobility.

But after NAFTA and China’s WTO entry, that equation was invalidated.

The new message from both parties was clear:

“Your job is gone. Adapt. Or die.”

The response from the professional class was smug, detached, and cruel.

- “Learn to code.”

- “Move to where the jobs are.”

- “The future is service-based.”

What they didn’t say is that the future they built had no place for most Americans.

This wasn’t creative destruction. It was economic euthanasia — carried out by technocrats who confused GDP growth with human well-being.

Walmart Nation and the Illusion of Plenty

As the industrial economy collapsed, consumerism was offered as a sedative.

Walmart became the new employer of last resort. It imported the very goods once made in American factories — at a fraction of the cost — and sold them to the newly underemployed.

But Walmart wasn’t just a store. It was a model for the post-industrial economy:

- Crush supplier margins.

- Demand overseas production.

- Strip labor costs to the bone.

- Offer rock-bottom wages to local workers.

- Rinse and repeat.

This model became so dominant that entire supply chains were restructured to serve it. And the message to workers was clear: the best you can hope for now is cheap stuff and a flexible schedule.

A flat-screen TV doesn’t replace a pension. But that was the tradeoff — whether people wanted it or not.

Suburban Facades and the Rot Beneath

Neoliberalism had one more trick up its sleeve: aesthetic camouflage.

Even as real wages stagnated and job security evaporated, Americans were told they were richer than ever:

- Mortgage rates were low.

- Credit was easy.

- Tech stocks were booming.

- And home equity became the new piggy bank.

It all looked fine — until you looked closer.

Beneath the surface:

- Household debt exploded.

- Families needed two incomes to survive.

- Healthcare costs skyrocketed.

- Higher education became a financial trap instead of a ladder.

The new American Dream wasn’t stability. It was survival masked as success.

Cultural Collapse and the Politics of Abandonment

It’s hard to measure what happens when a country loses not just jobs, but purpose.

The factory wasn’t just a place of employment. It was a place of identity, of pride, of intergenerational continuity. When those disappeared, so did the glue holding entire communities together.

And the fallout was brutal:

- Suicide rates spiked — especially among working-class men.

- Opioid deaths turned post-industrial towns into morgues.

- Mental health cratered. Life expectancy declined.

These weren’t just statistics. They were screams — and Washington didn’t hear them.

Because Washington wasn’t listening.

A Bipartisan Crime

The betrayal wasn’t partisan. It was structural.

- Clinton gave NAFTA its final push.

- Bush greenlit China’s WTO entry.

- Obama doubled down on globalization.

- Even Trump, despite the rhetoric, did little to rebuild domestic industry in any lasting way.

Republicans sold tax cuts. Democrats sold retraining programs. Both sold fantasies.

No one — not a single administration — reversed the course. Because both parties had become fluent in the language of Wall Street: profit margins, global competitiveness, capital mobility.

What they forgot? People.

A System That Cannot Be Reformed?

By the early 2010s, the damage was done. America no longer made things. It managed things:

- Supply chains.

- Logistics.

- Branding.

- Surveillance.

The real wealth was now upstream — in equity portfolios, algorithmic trading, and leveraged buyouts.

And anyone who questioned this trajectory?

Branded a populist. A protectionist. A dinosaur.

But here’s the truth:

- A country that doesn’t make things will eventually be owned by those who do.

- A people without control of production are not free — they’re tenants in someone else’s empire.

- And leadership that prioritizes balance sheets over human beings is not leadership at all.

The Final Irony

In a cruel twist, the very elites who engineered this collapse are now selling nostalgia back to us.

- Super Bowl ads full of American flags.

- Corporate rebrands invoking “Main Street” and “heritage.”

- Silicon Valley startups promising to “bring back American craftsmanship” — through drop-shipping and influencer marketing.

They know what they destroyed. And now they want to monetize the grief.

But the towns are still empty.

The factories still rust.

And the people still wait for a rescue that will never come.

Coming Up: Part V — Where Do We Go From Here (If Anywhere at All)

Part V: What Comes Next — And What Might Never Come Back

Let’s not sugarcoat it.

The American industrial economy wasn’t lost in a tragic accident. It didn’t die peacefully in its sleep. It was dismantled — slowly, cynically, and with surgical precision — by the very people we trusted to protect it. Executives, economists, think-tank technocrats, and bought-out politicians traded long-term national strength for short-term shareholder gains and a permanent seat at the Davos table.

The result?

A once-mighty engine of productivity has been reduced to a fragile scaffolding of warehouses, gig jobs, and service-sector spackle. A society that once built cities, aircraft, power plants, and railroads now lives off imports, strip malls, and stimulus checks. And we’re told that this — this — is progress.

But here’s the real question:

Now what?

Is there anything left to salvage?

Can we claw back even a fraction of what was lost?

Or is this just the final chapter — a slow-motion collapse buried under Amazon Prime deliveries, student debt, and TikTok filters?

This closing chapter won’t sell you hope. But it will tell you the truth.

Where We Really Are

Let’s start with brutal honesty.

America is no longer an industrial nation. We are a consumption-driven, debt-fueled service economy built on imports, logistics, and illusion. We measure economic “growth” by how many boxes got delivered, not how much was actually produced.

What we are today is a country where:

- Entire industries are offshore and unrecoverable

- Most working-age adults can’t afford a house without generational help

- Young people cycle through gig apps, not careers

- National infrastructure lags behind 1970s standards

- The “middle class” lives paycheck-to-paycheck, one car repair away from collapse

- Public schools double as daycare, food banks, and mental health triage centers

- Higher education is both unaffordable and economically useless for millions

This is decline disguised as normalcy.

And everyone feels it — even if they can’t name it.

We’re living in the ruins of a once-functional system, duct-taped together by credit scores and consumer sentiment surveys.

No One’s Coming to Save Us

There will be no Roosevelt moment.

No Truman-style mobilization.

No technocratic savior flying in with an industrial stimulus package and a dream.

Why?

Because the class that dismantled American industry now owns the future.

They hold the media. They hold the banks. They hold the think tanks, the universities, and the political consultants who script every false note of “optimism” we’re spoon-fed.

The people who broke the system are the ones writing the “solutions.”

And what they’re offering isn’t rebuilding — it’s containment.

They don’t want to rebuild Detroit.

They want to rebrand it — as an “innovation hub,” a playground for NGOs, consultants, and ESG investors.

Their version of the future looks like:

- Green-tech tax credits for hedge funds

- Apps that turn your car into a delivery service

- Fractional real estate ownership you’ll never live in

- AI bots replacing humans under the guise of “efficiency”

- Global supply chains that collapse every time a boat gets stuck in a canal

It’s not revival.

It’s managed decline — with better UX design.

And when that collapses, they’ll blame you.

What Would Real Recovery Actually Require?

Let’s suspend disbelief.

Just for a moment.

Let’s say we actually wanted to rebuild.

What would it take?

1. A National Industrial Policy

Not a one-off spending bill or photo-op ribbon cutting.

We’re talking a full-blown recommitment to national production — where sovereignty isn’t just a slogan, but a measurable reality.

That means:

- Strategic tariffs to defend key sectors from predatory foreign practices

- Domestic content mandates in infrastructure, defense, energy, and healthcare

- Full federal investment in core industrial capabilities: steel, semiconductors, rare earths, tooling, textiles

- Rebuilding vocational education from the ground up — shop class in every high school, apprenticeships linked to real jobs, and federal support for skilled labor instead of useless degrees

If you can’t make your own steel, grow your own food, or produce your own medicine — you are not sovereign. You are a tenant in your own country.

2. Break Wall Street’s Chokehold

No industrial revival is possible while finance dictates everything.

Wall Street has become a parasite. Its incentives reward liquidation, not investment. Its logic destroys long-term value for short-term arbitrage.

To stop this rot, we must:

- Reinstate Glass-Steagall to separate speculative finance from retail banking

- Ban stock buybacks — a legalized form of market manipulation

- Tax short-term capital gains like income

- Break up “too big to fail” banks and private equity firms

- Regulate venture capital before it turns every sector into a casino

- Nationalize or tightly regulate critical infrastructure sectors when necessary: water, energy, transportation, housing

Finance must serve the productive economy — not cannibalize it.

3. A True Labor Renaissance

Workers need more than lip service and branded hardhats.

They need power.

That means:

- Card-check union recognition as federal law

- Portable benefits for all workers, including freelancers and gig labor

- Living wage floors tied to real cost-of-living metrics, not manipulated CPI data

- Guaranteed paid leave, universal healthcare, and job retraining — not as perks, but as rights

- Make job security a social norm again — not an exception

Because a stable workforce is the foundation of a stable society.

4. Rebuild the Physical Nation

America has become digital-first and physically last. That has to change.

Our country is falling apart — literally. Roads, bridges, ports, rail lines, electrical grids, and water systems are outdated, crumbling, or dangerously fragile.

We need to:

- Repair and expand freight rail — the circulatory system of industry

- Rebuild regional ports and domestic shipping capacity

- Localize food and energy production for strategic resilience

- Fund public works in hollowed-out regions — not just tech corridors and gentrified cities

- Upgrade the national power grid for redundancy and sustainability — not vanity

This is how real countries build back strength — not through press releases, but through concrete, steel, and dirt under fingernails.

5. Dismantle the Corporate Uniparty

Let’s be blunt:

There is no real political opposition anymore.

Just two sides of the same donor class — red-branded corporatism and blue-branded corporatism, both taking checks from the same banks, defense contractors, and tech giants.

If we want democracy to mean anything again:

- Ban corporate PACs and SuperPACs

- Impose lifetime lobbying bans for government officials

- Enforce antitrust like it’s a national emergency

- Expand publicly funded elections to end the money-chokehold

- Jail political consultants who knowingly peddle false data to manipulate public trust

Until political sovereignty is restored, economic sovereignty is impossible.

The American Soul Is Tired

This isn’t just economic decay.

It’s spiritual exhaustion.

We are no longer a people that builds.

We are a people that scrolls.

We used to launch rockets.

Now we launch tweets.

We used to raise barns.

Now we raise “brand awareness.”

The loss of industry wasn’t just the loss of jobs — it was the loss of purpose.

The death of manufacturing took with it a sense of meaning. Of place. Of dignity.

And what filled the void?

- Influencer culture

- Hustle grifts

- Pills

- Porn

- FOMO

- Subscription models for survival

This isn’t just collapse.

It’s demoralization by design.

But Collapse Is Never Total

Empires don’t fall all at once.

They break unevenly.

And in the cracks, new life tries to take hold.

Across the country, far from the headlines, people are trying to build again:

- Tool-and-die shops in Midwest garages

- Worker-owned co-ops in forgotten steel towns

- Mutual aid networks operating without bureaucracies

- Former union men teaching welding and wiring out of community centers

- Digital migrants leaving the coasts for cheap rent and clean slates in the Rust Belt

It’s not flashy.

It won’t make the cover of The Atlantic.

But it’s real.

And it’s growing.

This is how civilizations begin to regenerate — not through grand revolutions, but through thousands of quiet acts of defiance and creation.

There’s No Going Back — But There Is a Way Forward

We’re not getting the 1950s back.

That world is gone.

But the values that built it?

Those can be reborn — not as nostalgia, but as necessity.

- Discipline

- Craftsmanship

- Stewardship

- Stability

- Interdependence

These aren’t Republican values or Democrat values.

They’re human values.

And they’re the only way out of this corporate fever dream.

If There’s a Way Out, It Starts With Memory

Before we can build again, we must remember what was lost.

We must remember:

- What it meant to earn and save

- What it meant to work with your hands

- What it meant to pass something down — not just throw something away

- And who, precisely, took that from us

Revival starts with clarity.

Clarity starts with memory.

And memory demands honesty.

This wasn’t an accident.

It was sabotage.

A demolition dressed up in policy briefs.

And the people responsible are still giving TED Talks and smiling for glossy magazine spreads.

Final Words

We were betrayed.

By the suits who called offshoring “inevitable.”

By the academics who said globalism was “neutral.”

By the politicians who sold out Main Street and blamed you for the wreckage.

They’ll tell you it was creative destruction.

That it made your life better.

That you’re just nostalgic.

Don’t believe them.

They demolished a nation — and now they want to sell you a subscription to the ruins.

So here’s the truth:

Even if the American empire is ending…

That doesn’t mean you are.

The best revenge is to build something that lasts — however small.

- A family

- A trade

- A business

- A life rooted in something real

They can take the factories.

They can take the pensions.

They can even take the dream.

But they can’t take the will to rebuild — unless you let them.

So don’t.